Insurance in South Africa

Insurance in South Africa plays a crucial role in providing financial protection and risk management for individuals and businesses. The country has a well-established insurance industry offers a wide range of products, including life insurance, health insurance, auto insurance, home insurance, and business insurance. The sector is regulated by the Financial Sector Conduct Authority (FSCA) and the Prudential Authority, which ensure the industry’s stability and protect policyholders’ interests.

Types of Insurance in South Africa

- Life Insurance:

- Provides financial security to the policyholder’s beneficiaries in the event of their death. Some policies also offer benefits for critical illnesses or disability.

- Health Insurance:

- Covers medical expenses, including hospitalization, doctor visits, and prescription medications. Medical aid schemes are prevalent in South Africa, offering comprehensive healthcare coverage.

- Auto Insurance:

- Protects against financial loss in vehicle damage, theft, or accidents. It includes comprehensive, third-party, fire and theft, and third-party-only coverages.

- Home Insurance:

- Covers the home’s structure and its contents against risks such as fire, theft, and natural disasters.

- Business Insurance:

- Protects businesses against various risks, including property damage, liability, and business interruption.

Best Insurance Companies in South Africa

best insurance companies in South Africa. Several insurance companies in South Africa are renowned for their comprehensive coverage, customer service, and financial stability. Here are some of the top insurance companies in the country:

- Discovery

- Discovery is a leading insurer in South Africa, known for its innovative health, life, and vehicle insurance products. It offers a unique wellness program called Vitality, which incentivizes healthy living.

- Discovery

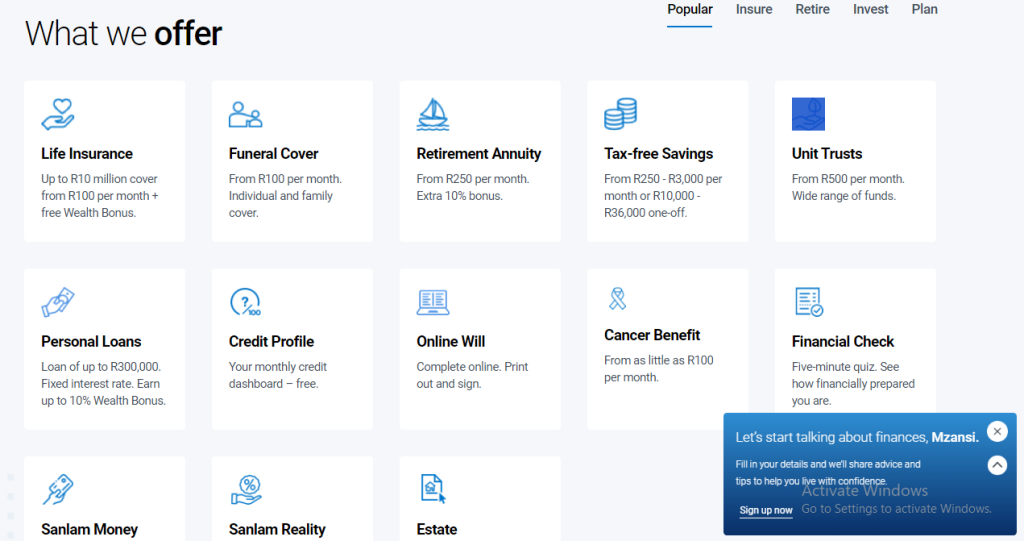

- Sanlam

- Sanlam provides various financial products, including life insurance, investment, retirement planning, and health insurance. It has a strong presence in the African insurance market.

- Sanlam

- Old Mutual

- One of the oldest and most trusted insurance companies in South Africa, Old Mutual offers comprehensive life, health, and general insurance products, along with investment and savings plans.

- Old Mutual

- Momentum Metropolitan Holdings

- This company offers diverse insurance products, including life, health, and short-term insurance. Momentum’s Multiply wellness program is similar to Discovery’s Vitality.

- Momentum Metropolitan Holdings

- Liberty Group

- Liberty provides extensive insurance solutions, including life insurance, health insurance, and investment products. The company is well-known for its customer-centric approach and financial advisory services.

- Liberty Group

- Hollard

- Hollard offers a broad spectrum of insurance products, including life, health, auto, and home insurance. It is also involved in business insurance and risk management services.

- Hollard

- Santam

- Specializing in short-term insurance, Santam is the largest general insurer in South Africa, providing coverage for personal, commercial, and corporate risks.

- Santam

Find Out More Visit How To Secure 100% Insurance Bid

Conclusion

The South African insurance market is robust and competitive, providing consumers with a variety of options to secure their financial future and protect against unforeseen risks. Leading insurance companies like Discovery, Sanlam, Old Mutual, and others continue to innovate and offer comprehensive products tailored to meet the diverse needs of their clients. When choosing an insurance provider, it is essential to consider factors such as the range of products, customer service, financial stability, and additional benefits like wellness programs.

What is Insurance

Insurance is a financial product that protects against potential financial losses or risks. By purchasing an insurance policy, individuals or entities transfer the risk of a potential loss to an insurance company in exchange for a fee, known as a premium. The insurance company then agrees to cover certain financial losses or liabilities that may arise under specific conditions outlined in the policy.